The Future of Enterprise Digital Identity: A Paradigm Shift with Global Mobility at its Core

The way enterprises manage digital identity is undergoing a radical transformation. Employees grapple with a multitude of credentials, IT departments face escalating security threats, and navigating regulatory compliance grows increasingly complex. Digital identity is the cornerstone of enterprise security, efficiency, and trust, yet many organisations still rely on fragmented and outdated systems ill-equipped for today's borderless, digital-first world.

Are your identity management processes keeping up with the digital age?

For CXOs, HR leaders, and product directors, outdated identity systems aren’t just an IT headache—they directly impact security, compliance, and workforce efficiency. With global mobility, remote work, and regulatory pressures increasing, businesses must rethink how they handle digital identity.

Why Change is Imperative: The Enterprise Identity Crisis

For years, enterprises have relied on centralized identity systems, requiring employees to juggle numerous passwords while IT departments maintain massive, breach-prone identity repositories. Here’s why the current approach is no longer sustainable:

🚨 Security & Fraud Risks: Credential theft accounts for over 80% of data breaches. Even Multi-Factor Authentication (MFA) is vulnerable to SIM swapping and phishing attacks.

💼 User Experience & Productivity: How much time does your IT team spend resetting passwords? How much productivity is lost due to access issues? Traditional identity management slows down employees and drains IT resources.

📜 Regulatory Compliance & High-Assurance eSigning: Industries like finance, healthcare, and legal must meet eIDAS, GDPR, and emerging European Digital Identity (EUDI) wallet requirements for secure digital transactions.

Where Traditional Identity and Access Management (IAM) Platforms Fall Short

Despite advancements, many IAM platforms have failed to adopt user-friendly, persistent identity solutions. Instead, they often rely on:

❌ Remote Identity Verification Without Regulatory Security Policies: Many solutions authenticate users remotely but lack government-regulated security standards like eIDAS, increasing vulnerability to fraud and non-compliance.

❌ Unfriendly Hard Tokens & OTPs: Employees still rely on cumbersome hardware tokens or one-time passwords (OTPs) that disrupt user experience and remain susceptible to phishing attacks.

As the workforce becomes more mobile and decentralized, enterprises need a seamless, secure, and compliant identity framework that employees can use across multiple applications and jurisdictions.

What’s the Alternative? Verifiable Credentials & Digital Wallets

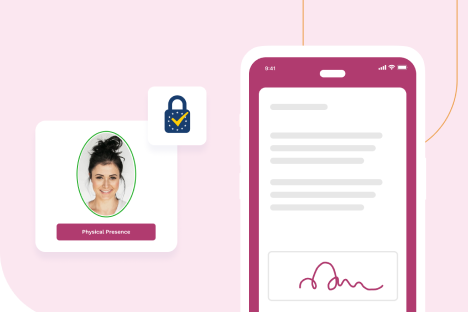

🔐 User-Controlled, Cryptographically Secure Identity Modern digital wallets empower employees by allowing them to hold and control their verifiable credentials. Instead of relying on a central database, credentials are digitally signed, cryptographically secured, and instantly verifiable.

⚡ Frictionless Authentication & Legally Binding Digital Signatures Employees can securely log in and sign documents with a single tap, eliminating complex password management. Compliance-ready digital transactions enhance security and efficiency.

How Leading Enterprises Are Using Digital Identity Wallets

🏢 Global Workforce Mobility & Right to Work Compliance: Streamline international hiring and remote work by verifying employee credentials instantly.

🏦 Banking & Secure Transactions: Prevent fraud with cryptographically verified credentials for high-assurance logins and legally binding agreements.

🔗 B2B Collaboration & Supply Chain Trust: Verify business partners and suppliers through decentralised identity solutions, reducing risk and increasing transparency.

A Case for Decentralised Identity in Global Mobility

The Problem: Inefficient, Risk-Prone Mobility Processes

For large enterprises handling thousands of employee relocations annually, mobility remains fragmented. Employees struggle with:

✅ Multiple contacts and agencies

✅ Tracking scattered onboarding tasks

✅ Repeatedly submitting sensitive ID documents

The Solution: A Secure, Streamlined Identity Wallet

A government-regulated identity anchor (eIDAS) + digital wallet provides a seamless and secure credential exchange, giving employees full control over their identity.

How it works:

1️⃣ Onboarding: Employees register using eIDAS-compliant methods, creating a trusted digital identity.

2️⃣ Credential Acquisition: Verified employment credentials are securely stored in the digital wallet.

3️⃣ Secure Transactions: Employees instantly share verified credentials with HR, relocation firms, and service providers.

4️⃣ User Control: Employees decide who gets access to what information, ensuring privacy and security.

Why Your Enterprise Needs This Now

✔ Reduce onboarding delays: Cut down relocation and hiring time.

✔ Enhance security: Protect employee identity from breaches.

✔ Meet compliance standards: Stay ahead of regulations like eIDAS & GDPR.

✔ Boost employee experience: Give staff control over their digital identity.

What’s Next? Preparing for the Future of Digital Identity

🚀 The European Digital Identity (EUDI) wallet is coming, but widespread implementation may take years. Enterprises can’t afford to wait.

✅ Private sector Verifiable Credentials are already in production, offering a faster, more agile path to secure digital identity.

|

Approach |

Pros |

Cons |

|

EUDI Wallet |

Government-backed, standardized, high assurance, pan-European interoperability |

Slow adoption, reliance on public sector readiness, limited initial functionality |

|

Verifiable Credentials |

Fast deployment, private-sector agility, broad adoption, flexible use cases |

May lack initial regulatory standardisation, potential interoperability issues |

Introducing ZealiD: The Plug-and-Play Digital Identity Wallet

ZealiD is a leading solution for employee and customer digital identity wallets. As a plug-and-play solution, ZealiD enables enterprises to:

✅ Seamlessly onboard employees and customers with eIDAS-compliant identity verification.

✅ Provide a single, persistent digital identity for login, transactions, and legally binding signatures.

✅ Ensure compliance with EU regulations and reduce the burden of fragmented identity management.

✅ Improve security and user experience through biometric authentication and verifiable credentials.

Take the next step

Future-Proof Your Enterprise Identity Today

Contact ZealiD to implement a plug-and-play digital identity wallet for your organisation.